Insights

October 31, 2025

Hindustan Unilever’s Ice Cream Division to Operate as Independent Entity: NCLT Clears Demerger into Kwality Wall’s (India) Limited →

October 31, 2025

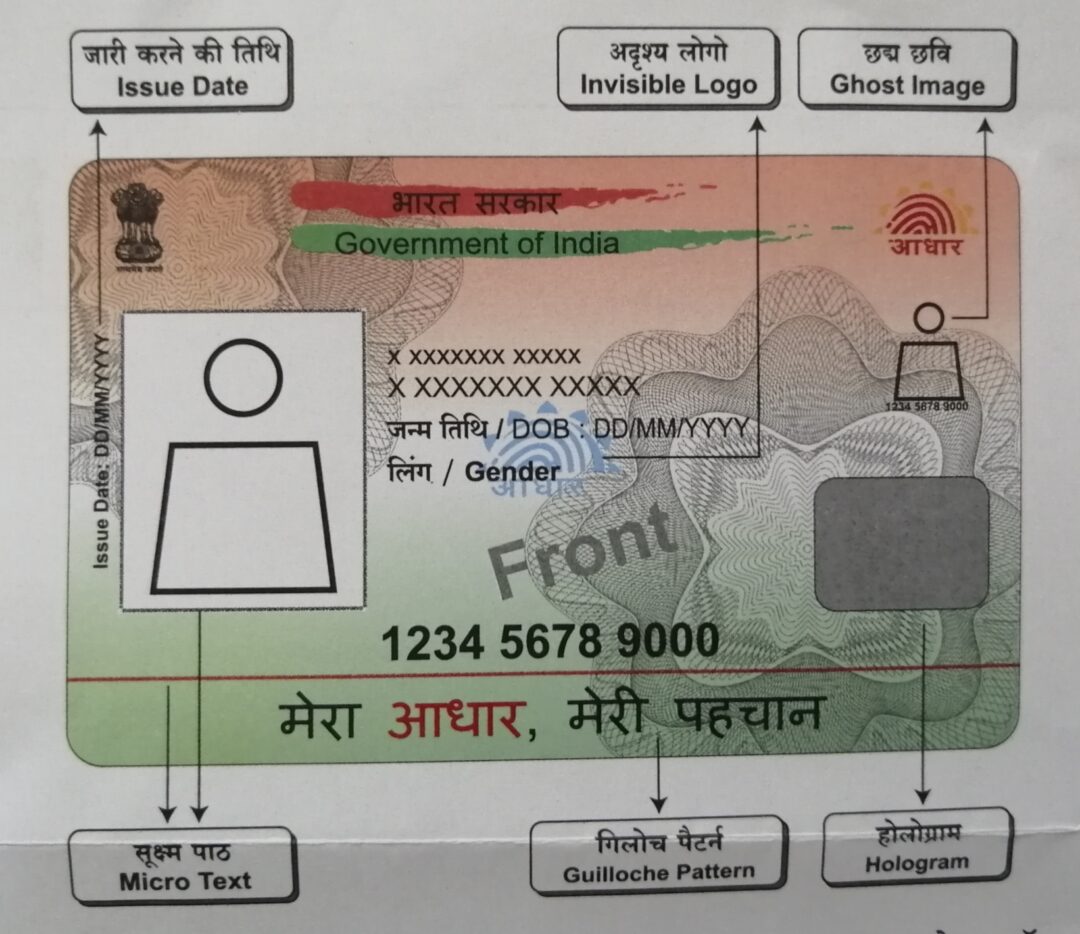

Aadhaar Card Holder Has Fundamental Right to Seek Alteration of Name and Other Details →

October 31, 2025

When Banking on Fraud-Reporting Backfires: Delhi HC Quashes Criminal Defamation Case Against Bank CEOs →

October 30, 2025

Pay First, Recover Later: SC Reiterates Humanitarian Approach in Motor Accident Compensation →

October 30, 2025

Supreme Court Reaffirms Protection to Bona Fide Purchasers in VAT Transactions: Commissioner, Trade & Tax. →

October 30, 2025

Registrar Has No Statutory Authority to Issue NOC for Redevelopment, Rules Bombay High Court →

October 29, 2025

Delhi High Court Upholds Crocs’ Design and Brand Integrity in Questsole Dispute →

October 29, 2025

Supreme Court Clarifies: Redeemable Preference Shareholders Are Not Financial Creditors Under IBC →

October 28, 2025

Medical Devices Step Out of Legal Metrology (Packaged Commodities) Shadow: 2025 Amendment Ends Labelling Confusion →

October 28, 2025

No Shield of Rule 9(5) When Bank Suppresses Court Order: Telangana HC Refunds ₹2.16 Crore to Auction Purchaser →

October 28, 2025

Concealment of Free Seats Amounts to Unfair Trade Practice: Maharashtra Commission Finds Emirates Airlines Deficient in Service →

October 28, 2025

Security Cheques vs. Enforceable Debt: Delhi High Court Reiterates Limits of Section 138 NI Act →

People

Meet our team of experts

Careers

Explore career opportunities

Contact Us

Tell us what you're looking for

Subscribe

Legal developments to your inbox